Finance in Business: Importance and strategy

Introduction

Finance is the backbone of any business. Proper planning and effective utilization of financial resources are very important for a successful business. The main objective of “Finance in Business” is to understand all the financial aspects of business and to use them properly so that growth is possible.

The Role of Finance in Business

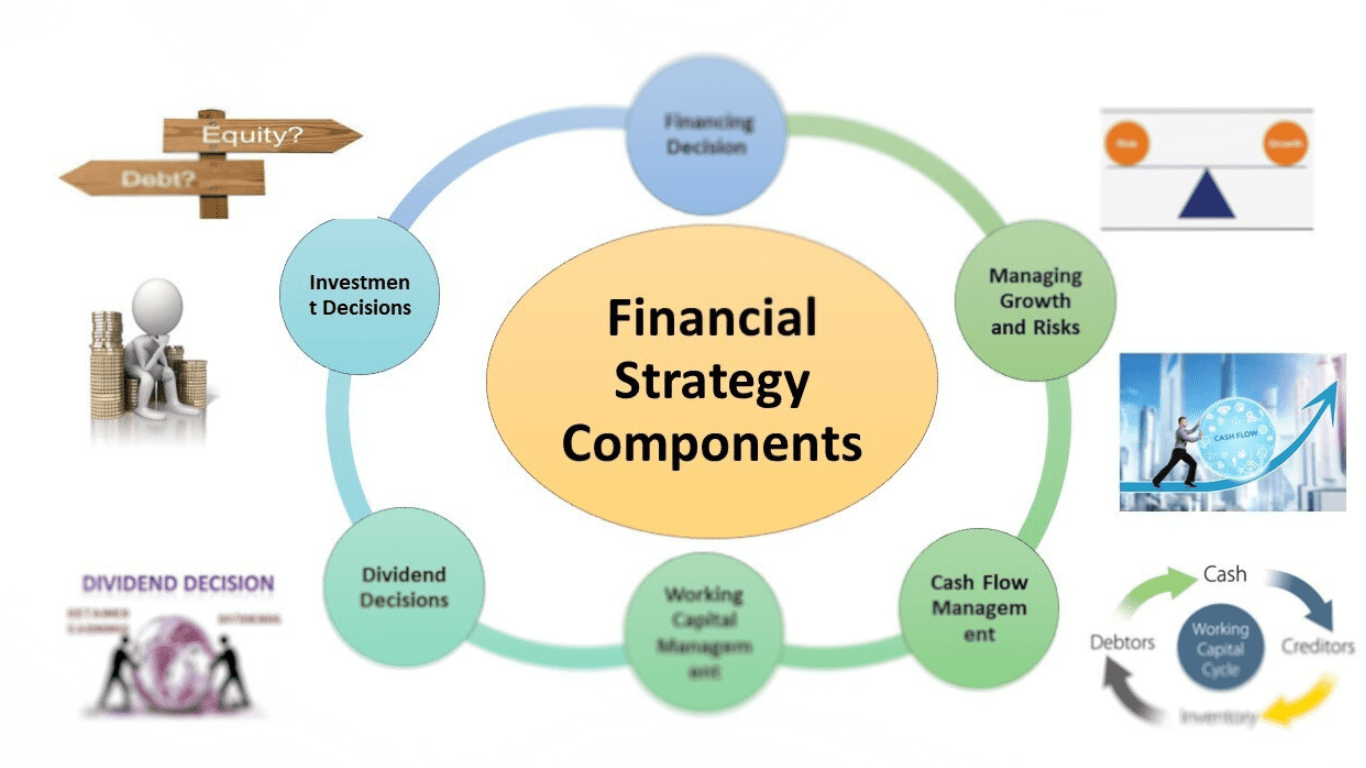

Finance is a vast and important field in the business world. It impacts several facets of business, including:

- Formulation of Budget: A clear budget is essential for running a business so that income and expenditure can be balanced.

- Investment Decisions: Investment in any business is an important decision, which requires financial data and analysis.

- Risk Analysis and Management: Finance helps in identifying and addressing financial risks in business.

- Cash Flow Planning: Ensuring the availability of cash is essential for the survival and growth of a business.

- Profit maximization: Another important aspect of finance is how to improve the profitability of the business.

Types of Finance in Business

- Corporate Finance: Finance is used to manage the financial affairs of large companies, including investment, dividend policy and financing strategy.

- Personal Finance: An individual’s financial planning that includes savings, investments and loans.

- Public Finance: Used to manage the government’s fiscal policies and expenditures.

- International Finance: International business transactions and investment matters fall under this category.

finance in buisness

Strategies to grow a business through finance

1. Best Financial Planning

An effective financial plan is essential for business success. It sets short-term and long-term goals to set the path for growth.

2. Sound investment decisions

Investment is an essential element for the future of the business. By making the right investment at the right time, the business can expand.

3. Reducing costs

High costs can be detrimental to any business. Therefore, by reducing the unnecessary expenses, it is possible to increase the profit.

4. Proper tax planning

Paying taxes is a necessary process in business. Businesses can reap financial benefits if tax planning is done correctly.

5. Credit Management

Optimizing the borrowing and lending process improves the financial stability of the business. Timely repayment of loans and proper utilization of financial resources are very important for development.

6. Finding new opportunities

Finding and exploiting new opportunities in the market is essential for success in business finance.

Financial challenges in business and their solutions

- Shortage of cash: This can be solved through business loans, investments or better financial planning.

- High amount of debt: The business should plan the debt properly so that financial difficulties do not arise.

- Changes in the market: Improving your financial strategy according to the changing trends can protect the business from losses.

The result

Unquestionably, “finance in business” is crucial. A successful business is one that manages financial resources properly and makes wise financial decisions. Good financial management can set a business on the path of success and growth.